Daily Market Dose

Last Updated on September 27, 2023 by BFSLTeam BFSLTeam

24th August

In Thursday trade session, Indices erase gains from its opening, trade flat at around 12.15 pm.

On Nifty Realty index up 1%, while Bank Nifty shows strength at 44,600 levels.

Adani Enterprises, IndusInd Bank, BPCL, Asian Paints and Infosys are among the major gainers on the Nifty, while losers are Hindalco, Divis Labs, ONGC, LTIMindtree and M&M.

NIFTY

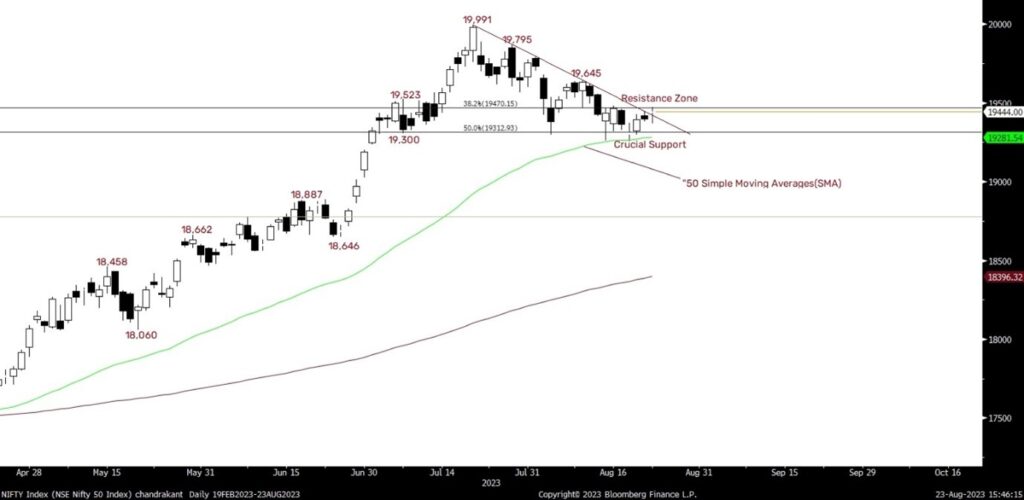

- In Wednesday’s trade session, the market started positively but drifted lower during the first half. However, buying picked up later, leading the indices to close positively at 19,439.

- The daily chart shows a “Doji” pattern, indicating uncertainty. Immediate resistance is at 19,500, with support around 19,350.

- If the resistance at 19,500 is crossed, an upward movement towards 19,550 and 19,630 could follow. Failure to breach 19,500 might lead to sideways or downward movement.

Support and Resistance

- Nifty: Immediate resistance is situated at 19,500, followed by 19,560 levels. Conversely, downside support is located at 19,400, followed by 19,350.

- Bank Nifty: Intraday resistance is positioned at 44,700, followed by 44,950, while downside support is found at 44,350, followed by 44,100.

- Fin Nifty : Intraday resistance is positioned at 19,800, followed by 19840 while downside support is found at 19685, followed by 19630.

News that can impact the market today

- India Tax dept plans to reduce average time taken for issuing refunds to 10 days

- Indian Govt set to ban sugar exports from October for first time in 7 years

- Vegetable price inflation to decline from Sept: RBI Gov

- Shriram Properties & Ask Property Fund invest ₹206 cr in a residential project in Chennai

- Government has extended Section 11 to imported coal-based power generators till October 31, 2023

- HULST BV (Baring) to sell its entire stake (26.63% equity) in Coforge via block deal. Floor price at ₹4,550/share which is 7% discount to CMP

- Reliance Retail Major Development: Qatar Investment Authority to invest Rs 8,278 crore for 0.99% stake. QIA’s investment will translate into minority equity stake of 0.99% in RRVL on a fully-diluted basis

- Coal India working on listing two subsidiaries

- HCLTech collaborates with AWS to drive GenAI adoption.

- NHPC: Co Signed MOU with Andhra Pradesh Power Generation Corporation

- Vascon Engineers: Co Received Letter of Acceptance Amounting to 6.06B Rupees

- GAIL (India): co plans rupees 30,000 cr capex in next 3 years; focus on pipeline, petchem

Standard Disclaimer

Investments in the securities market are subject to market risk, read all related documents carefully before investing. Research Disclaimer

Broking services offered by Bajaj Financial Securities Limited (BFSL) | Registered Office: Bajaj Auto Limited Complex , Mumbai –Pune Road Akurdi Pune 411035 | Corporate Office: Bajaj Financial Securities Ltd,1st Floor, Mantri IT Park, Tower B, Unit No 9 & 10, Viman Nagar, Pune, Maharashtra 411014| CIN: U67120PN2010PLC136026| SEBI Registration No.: INZ000218931 | BSE Cash/F&O (Member ID: 6706) | DP registration No : IN-DP-418-2019 | CDSL DP No.: 12088600 | NSDL DP No. IN304300 | AMFI Registration No.: ARN – 163403|

Research Services are offered by Bajaj Financial Securities Limited (BFSL) as Research Analyst under SEBI Regn: INH000010043. Kindly refer to www.bajajfinservsecurities.in for detailed disclaimer and risk factors