Daily Market Dose

Last Updated on September 27, 2023 by BFSLTeam BFSLTeam

29th August, 2023

Indian benchmark indices Nifty 50 and Sensex are recovering from their day’s lows at halftime. While Nifty 50 has crossed the 19,350 mark, Sensex is up over 100 points.

Bharti Airtel, Jio Financial, APL Apollo, Zee Entertainment and AMI Organics are among the most active shares on the BSE. Metal and realty indices up 1 percent each, while capital goods and power index up 0.5 percent each.

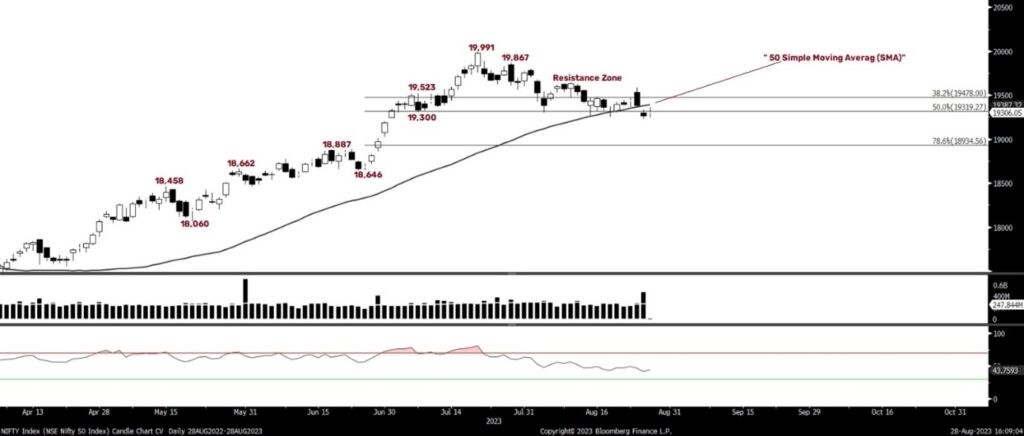

- On Monday, the markets began with a substantial gap up and traded in a choppy manner throughout. The overall index witnessed a marginal positive of 0.21% and closed at 19,306.

- On a daily time scale, the index encountered resistance from its 50 SMA and closed below it, indicating selling pressure at the higher level.

- However, it is close to the 0.50% Fibonacci retracement level, which is a key point to watch for the upcoming trading session. If the price remains below, a further downward movement is possible.

- Fresh buying may be possible above the 19,500 mark, which is immediate resistance for the index; however, if the price remains below 19,250, it may fall towards the 19,000 level.

Support and Resistance

- Nifty: Immediate resistance is situated at 19,360, followed by 19,440 levels. Conversely, downside support is located at 19,250, followed by 19,200.

- Bank Nifty: Intraday resistance is positioned at 44,700, followed by 44,900, while downside support is found at 44,250, followed by 44,100.

- Fin Nifty : Intraday resistance is positioned at 19,830, followed by 19885 while downside support is found at 19690, followed by 19650.

News that can impact the market today

- On APL Apollo, the #BlockDeals Promoter may sell up to 26.3 lakh shares (0.85% equity) via block deals. The floor price is likely at Rs 1,595/sh, with a 4.3% discount to CMP. The block size is likely at Rs 303 cr, and the greenshoe at Rs 116 cr.

Relief for Vodafone Idea as ATC agrees to give it more time to pay dues. - Man Infra takes a redevelopment project in Mumbai, revenue potential at ₹4,000 cr over 5 years

- Bharat Petroleum Corp (BPCL) on Monday said it will spend around Rs 1.5 trillion, in the next five years, towards its transformative initiative, ‘Project Aspire’.

- India’s automotive industry poised to rank number 3 in the world by 2030: Ministry of Heavy Industries

- LTIMindtree collaborates with company, ‘CAST AI’ to help businesses optimize their cloud investments

- Nita Ambani has stepped down from the Board of Directors of Reliance but will attend all Board meetings as a permanent invitee, says Mukesh Ambani at the 46th AGM of Reliance Industries.

- PG Electroplast launches QIP to raise ₹500 cr, floor price at ₹1,641.09/sh. QIP proceeds to be utilised for funding working cap returns of subsidiary and for capex spends of co & subsidiary.

- Indiabulls Real Estate (IBREL): Says Atul Chandra named as Chief Operating Officer of the company from Aug. 28

- Zomato (ZOMATO): Internet Fund III Pte Ltd sold 123.5m shares: BSE Bulk Deals

- Jio Financial Services to enter insurance sector with global partners

- Piramal Enterprises buyback opens on August 31 & closes on September 6, 2023

Disclaimer- Standard Disclaimer

Investments in the securities market are subject to market risk, read all related documents carefully before investing. Reg Office: Bajaj Auto Limited Complex, Mumbai –Pune Road Akurdi Pune 411035. Corp. Office: Bajaj Financial Securities Ltd., 1st Floor, Mantri IT Park, Tower B, Unit No 9, Viman Nagar, Pune, Maharashtra 411014. SEBI Registration No.: INZ000218931 | BSE Cash/F&O (Member ID: 6706) | NSE Cash/F&O (Member ID: 90177) | DP registration No: IN-DP-418-2019 | CDSL DP No.: 12088600 | NSDL DP No. IN304300 | AMFI Registration No.: ARN – 163403. Website: https://www.bajajfinservsecurities.in/